Fraud prevention solutions are the advanced tools and mechanisms to prevent any unauthorized access, identity theft, and financial crimes before they materialize. These solutions are inclined toward implementing artificial intelligence, device intelligence, and behavioral analytics to detect red flags in their infancy. While many financial institutions and businesses use real-time data, location analysis, and identity verification to limit risk and protect customer data, these implementations consist of a mix of software-based solutions and policy-based actions.

ID Fraud Prevention

ID fraud protection: Involves verifying the identity using methods such as two-factor authentication, biometric scanning, and checks against government-issued documents. This second layer protects provisioned users by verifying their identity during account set-up or when doing high-risk transactions. Active identity monitoring will help to identify unusual login activity and notify users instantly to mitigate against account takeover.

Protection for Identity Theft

Identity theft protection involves monitoring the use of your Social Security number, credit files, and personal information in public and dark web sources. Such services check thousands of data points to notify you when your information appears in extraordinary areas. Modern platforms now offer identity restoration services, enabling the swift recovery of victims by collaborating with credit bureaus and financial institutions.

Theft ID Protection

Theft ID protection: Enhances prevention activities, such as alert systems, credit freezing options, and safe storage of sensitive documents. These tools are especially efficient against synthetic identity fraud, in which created identities are built upon real fragments of data. Consumers may enroll in alert programs when unusual inquiries or new account openings arise against their name.

ID Theft Protection

Identity theft protection diverges in the fact that insurance coverage for legal fees and lost wages from identity theft is usually included. A great many services offer 24/7 support and case managers to aid in recovery. These services are key to individuals who have a high online presence or travel a lot; such people are often more prone to data breaches.

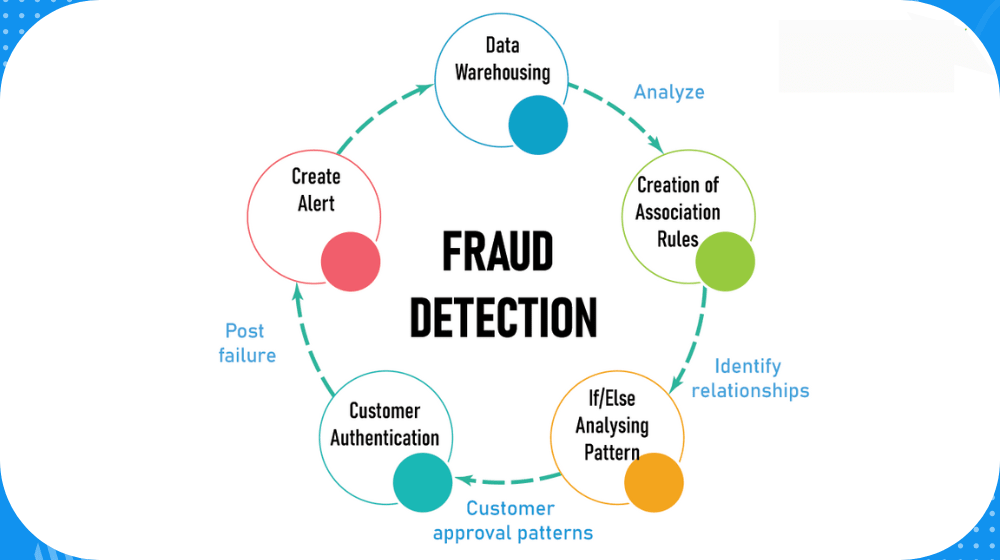

Fraud Prevention

In looking at particular types of identity protection, identity fraud prevention actually accounts for transaction risk analysis, customer behaviour modeling, and fingerprinting of devices. These systems serve as detection mechanisms for abnormal behavior, all of which may indicate fraudulent activity. These include multi-layer security that increasingly banks have been depending upon to build trust in the financial system while at the same talisman reducing their digital fraud prevention losses.

Debit Card Protection

All debit cards are protected from theft or unauthorized access to funds that are directly linked to checking or savings accounts. The setup process involves instant transaction alerts, daily withdrawal limits, and geo-restriction as far as card use is concerned. Other banks today have gone ahead to introduce virtual debit cards for online purchases, and that will give an extra protection against breaches in data.

Identity Theft Protection UK

For people in the United Kingdom, identity theft protection UK services implement both the GDPR and FCA regulations. These monitor national databases and provide tailored digital fraud prevention score alerts to notify customers of possibly suspicious changes in their credit histories or public records. UK-based services tend to work in conjunction with local credit agencies and are often complemented by rapid response mechanisms such as notifying police or banks.

Debit Card Fraud Prevention

Fraud on debit cards is when someone uses your debit card information, without your authority, to purchase items or withdraw cash. This is how these transactions differ from credit card fraud: With debit card fraud, detection is much more difficult because the funds are directly removed from your active checking account. Advanced fraud prevention detection tools now track ATM usage patterns, IP address locations, and sometimes even specific device locations to catch these incidents before losses escalate.

Fraud on Debit Card

When handling any debit card fraudulent activity, it’s always best to report unauthorized debit transactions once they’re noticed. Most banks have zero liability provided you act in good time. Digital wallets such as Apple Pay and Google Wallet help reduce these risks by preventing merchants from receiving card numbers for the purchase.

Fraud Prevention Credit Card

A fraud protection credit card’s benefit is complete transaction behavior monitoring. They can also temporarily lock the card if a transaction appears suspicious, requiring the user to verify the activity. Some even offer features such as dark web monitoring or notifications of data breaches as extra perks.

Credit Card with Fraud Protection

Using a credit card that has digital fraud prevention defense ensures you are not liable for unauthorized charges. Look for cards that offer alerts almost instantly and have a reliable customer service with a quick response time. Many premium cards also provide their users with a feature to create temporary numbers to use during a purchase on the internet.

Fraud Protection on Credit Cards

It is possible to attain a high-speed security application in credit-card digital fraud prevention when it comes to real-time monitoring or monitoring of the activity of that credit card account. As a result, it will send you a transaction alert where you will identify the purchases made using your card. If you find out that there are indeed purchases made that you didn’t, then you could immediately freeze the card or inform the provider. Tokenization and EMV chip technologies have demonstrated prospects as useful elements in reducing the disruptive footprint against digital fraud prevention risk.

Fraud Protection for Credit Cards

Usually, credit cards come along with fraud defense: stealing electronic data and a chargeback assistance for cases of fraudulent emergencies. These services assured the preservation of consumer trust and loyalty amid competitive banking environments. Frequent travelers tend to give priority to such specific protections, given the high risk of these types of transactions.

Credit Card Fraud Protection

Advanced fraud prevention engines powered by machine learning may also constitute a credit card fraud defence. These compare the pattern of behavior of ten thousand users, devices, and locations, predicting that certain actions would be deemed unusual. Firms will also be able to feed such systems into their checkout to prevent fraud in real-time within typical transactions.

Credit Cards with Fraud Protection

Most banks provide credit cards, which offer clients bundled fraud defense features into their reward programs. Not only do clients earn points, but they also gain their coveted peace of mind because of the included security features. These facilities come especially in handy during online shopping and in peak travel seasons.